Making sense of the markets this week: July 14, 2024

U.S. inflation down, consumers are buying less Pepsi, Delta suffers from increased expenses and competition, Amazon’s 30th birthday has shareholders celebrating.

Advertisement

U.S. inflation down, consumers are buying less Pepsi, Delta suffers from increased expenses and competition, Amazon’s 30th birthday has shareholders celebrating.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

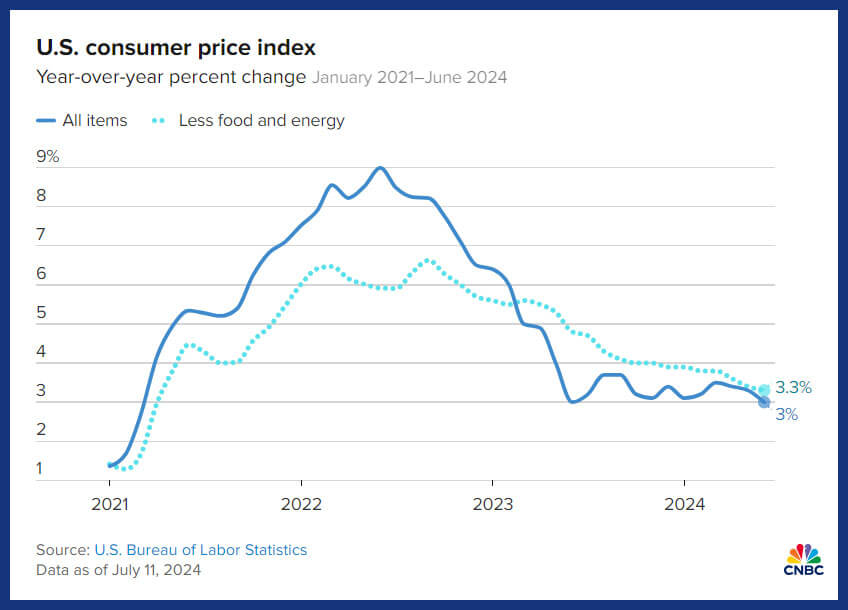

While Canada’s inflation rate is obviously at the forefront around decision making for the Bank of Canada (BoC) in setting the key interest rate, inflation below the border is also a major consideration. Arguably, policymakers are loath to devalue the Canadian dollar beyond a certain level. Consequently, if U.S. inflation stays high—and U.S. interest rates correspondingly stay high—it will likely impact just how quickly the BoC can cut our interest rates.

“The Canadian and American economies are very closely intertwined, especially when it comes to the cost of borrowing. Historically the BoC and the Fed have mirrored each other in terms of monetary policy (the act of cutting, holding, or hiking their benchmark interest rates).”

—Penelope Graham, mortgage expert

Markets were mostly flat on Thursday after the U.S. Bureau of Labor Statistics announced that headline CPI was down 0.1% from May, and the 12-month inflation reading was now 3%.

The CPI report included the following details:

Overall, the down-trending inflation rate, as well as Fed Chairman Jerome Powell’s comments about holding interest rates too high for too long this week, both seem to indicate a probable rate cut in September. CME Group’s FedWatch tracker uses futures contracts to predict the likelihood of interest rate movements, and it currently shows a strong likelihood of two interest rate cuts before the end of 2024. There is even a 40% probability of three cuts before year end.

Obviously this is welcome news to indebted Americans, but also to Canadian consumers who want to see interest rates come down here sooner rather than later.

—Kyle Prevost

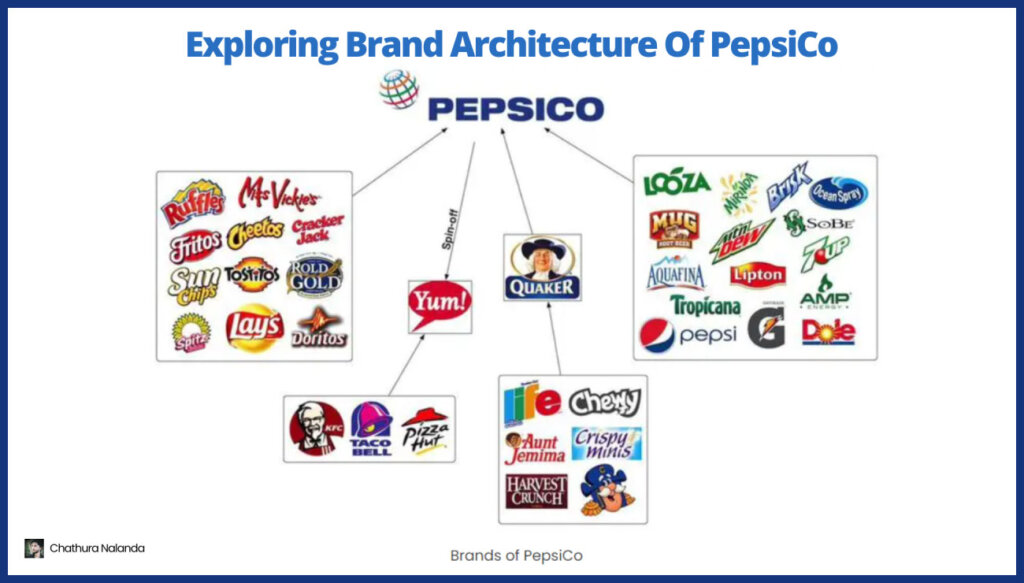

Beverage-and-snack behemoth PepsiCo released lukewarm earnings news on Thursday. For those who aren’t familiar with Pepsi’s corporate structure, it long ago ceased to be a single-beverage entity. With brands ranging from numerous snack and soft drink choice to breakfast cereals, Pepsi is a diversified food conglomerate, including FritoLay and Quaker.

All figures in U.S. dollars.

The company cited a declining demand in North America as the main factor in slowing revenue growth. Company executives explained that North American consumers were becoming more price conscious after failing to “push back” on significant price increases over the last few years. Low-income shoppers were highlighted as being the most willing consumer group to shift to cheaper private-label options. As well, increasing agricultural commodity costs were cited as an increasing operating expense. It’s worth noting that some market watchers believe weight-loss drugs, such as Ozempic and Wegovy, may curb demand for snack foods in the North American market.

FritoLay’s North America sales were down 4% year over year, while North American beverages were down 3%. Those sales declines were offset by international revenue increasing by 7% year to date. Management highlighted that this was the 13th straight consecutive quarter with at least mid-single-digit organic revenue growth for international operations.

Bottom-line numbers were also affected by the 17% volume decline from the Quaker Foods North America division, mostly due to salmonella contamination recalls in December and January.

Overall, it appears that consumers are finally taking action when it comes to the grocery budget (as opposed to merely complaining about it on surveys). It will now be up to food and beverage companies to respond with discounts and more efficient supply chains in order to reclaim North American shopping cart space.

—K.P.

Provide a 30-day notice before withdrawing your cash and earn 5% (or 4.5% when you provide 10-day notice).

Lock in your deposit for one year and earn a guaranteed interest rate of 4.85%.

$0 commission on all online stock transactions. No minimum deposit needed.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

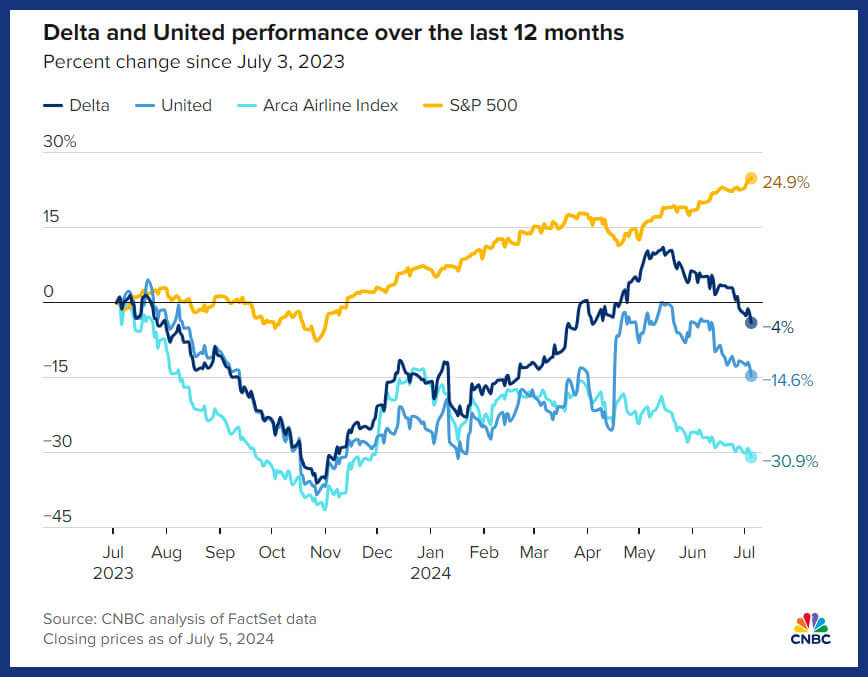

Delta also reported earnings on Thursday and gave us some insight into what’s winning the tug of war: higher travel costs versus our post-pandemic obsession for “buying experiences over stuff.” As the most profitable airline in the US, Delta’s earnings are often used as a benchmark for the broader travel industry.

Figures in this section are in U.S. currency.

While earnings and revenues came in right in line with expectations, Delta lowered its future revenue forecasts. Consequently, the stock was down 4% on Thursday.

While revenue was up 5.4% year over year, net income was down nearly 30%, due to greatly increased operating expenses. CEO Ed Bastian said, “The second quarter was a really strong performance. What you see happening is the impact in the domestic marketplace to the lower fare discounting that’s been going on this quarter.”

When you consider that Delta’s first class ticket revenues jumped up 10% from the prior quarter, but only 0.3% for coach tickets, it’s pretty easy to see the effects of increased competition. Canadian consumers might wonder if one day they too might see this phenomenon known as “competitor airlines.”

Compare Delta to other Canadian airline stocks at MillionDollarJourney.com.

—K.P.

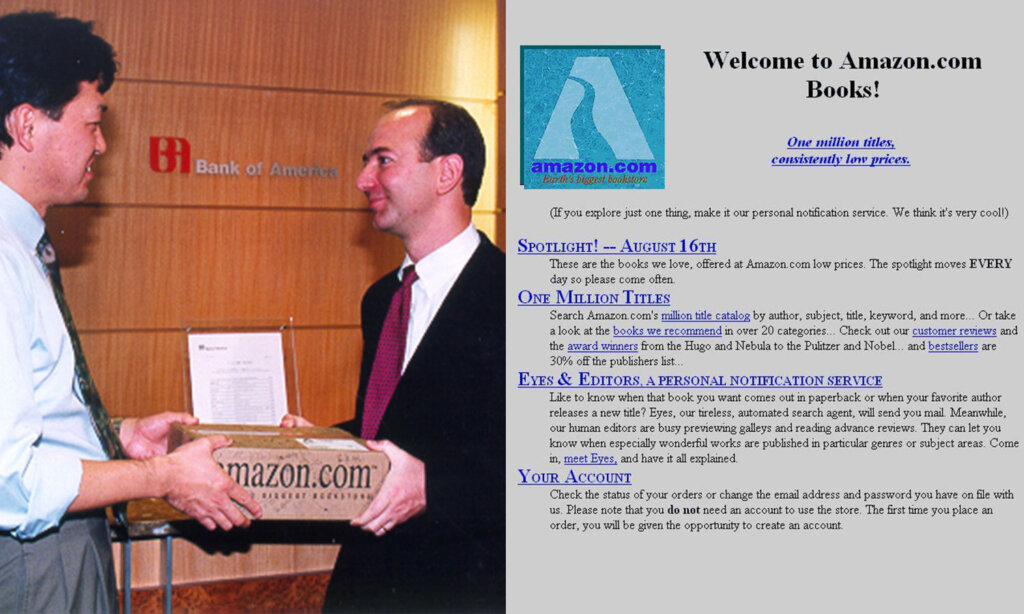

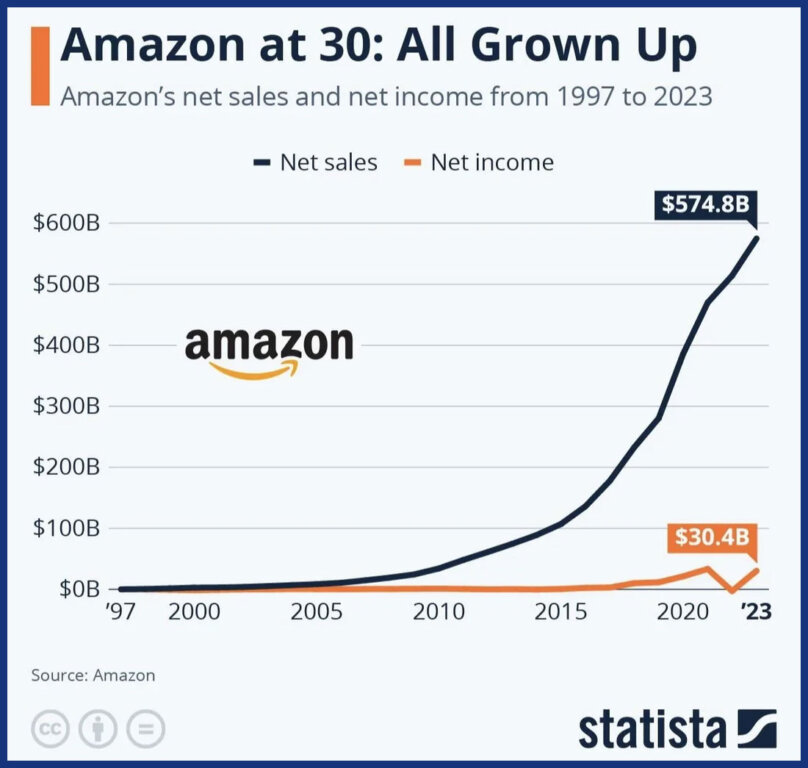

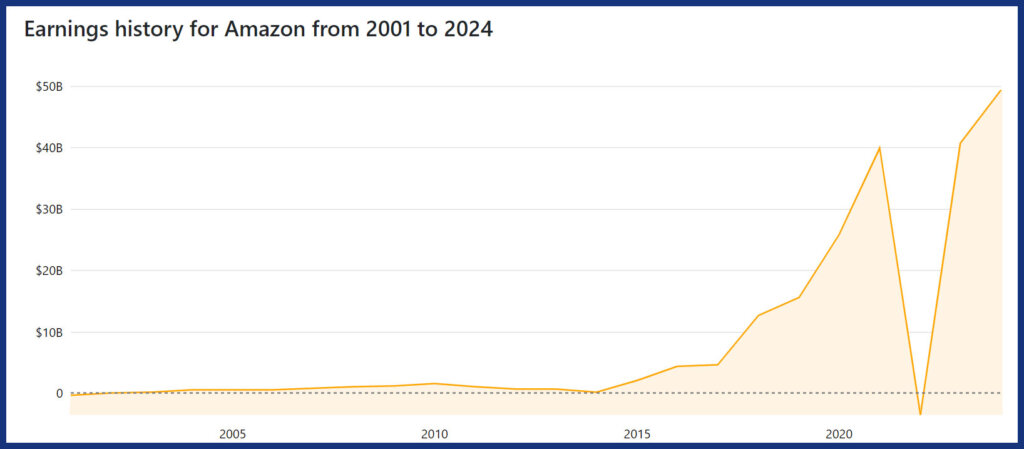

On the eve of its annual Amazon Prime deals bonanza, founder and executive chairman Jeff Bezos’ corporate baby turns 30 next week.

“Amazon is not too big to fail. In fact, I predict one day Amazon will fail. Amazon will go bankrupt. If you look at large companies, their lifespans tend to be 30-plus years, not a hundred-plus years.”

–Jeff Bezos, once told employees

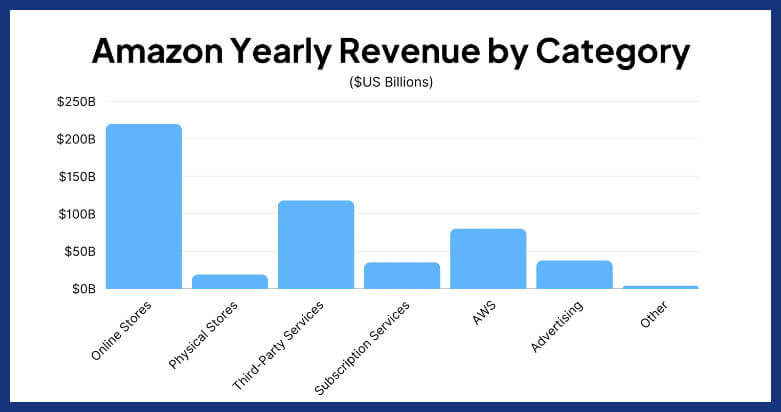

Here are a few facts about the online retail empire Amazon (AMZN/Nasdaq). All figures are U.S. dollars.

Perhaps most interesting is that Amazon has long since diversified away from simply being a massive seller of books and electronics. Today, much of the company’s revenue comes from hosting websites and even being an advertiser for other firms.

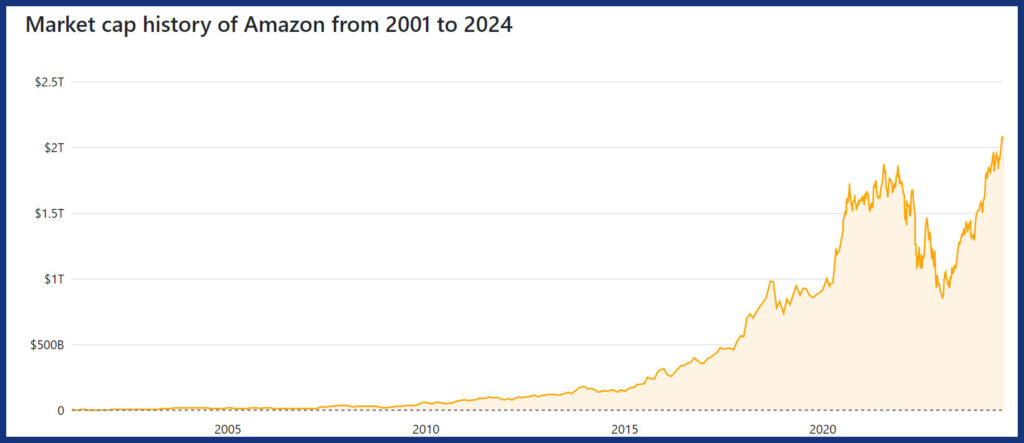

Amazon had its initial public offering (IPO) on May 15, 1997 and began trading at $18 per share. If you purchased 56 shares of Amazon stock for about $1,000 then, they’d be worth about $2.5 million today, after accounting for stock splits.

Now, what will Amazon look like on its 60th birthday? It appears that Bezos’ prediction for a 30-year lifespan will fade well into the rearview mirror, given Amazon’s incredible trajectory and the essential nature it plays in many consumers’ lives.

—K.P.

As we went to press Friday morning, results started to appear from some of the major U.S. banks. Reuters reported that JP Morgan Chase & Co. (JPM/NYSE) had a 25% jump in second-quarter profit because of rising investment banking fees and a USD$8 billion accounting gain from a share exchange with Visa (V/NYSE). Shares are up 22% year to date but slipped 0.6% before the bell Friday. Meanwhile, shares of Wells Fargo (WFC/NYSE) fell 5% in pre-market trading on a decline in second-quarter profit. Finally, Citigroup (C/NYSE) beat expectations for second-quarter profit on a 60% jump in investment banking revenue but the share price dropped 1.4% soon after trading began Friday. We may look at these in more depth at these and other U.S. banks next week.

—Jonathan Chevreau

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email