40 and no pension: What do you do?

You’ve reached your 40s, are mid-way in your career and realize you’ll never have a pension. Here’s how to get ready for retirement.

Advertisement

You’ve reached your 40s, are mid-way in your career and realize you’ll never have a pension. Here’s how to get ready for retirement.

Pension envy is real. That’s because, when it comes to retirement planning, a defined-benefit pension does the heavy lifting for you. Contributions come right off your paycheque and go into a pool of pension dollars that will fund your retirement, or most of it, anyway. It’s the ultimate “pay yourself first” approach—you don’t even get a chance to spend the money because it’s taken right from the source. But what if, like most working Canadians today, you have no pension? What if you’ve hit 40 and have no retirement savings to speak of?

It’s not as big a problem as you might think. The key is to try to mimic the pay-yourself-first approach by setting up an automatic contribution to your registered retirement savings plan (RRSP) to coincide with your payday. A good rule of thumb to strive for is 10% of your gross income. Remember, in most cases the employees blessed with a defined-benefit pension are contributing around the same 10% rate (sometimes more) to their pension plan. You need to match those pensioners stride-for-stride.

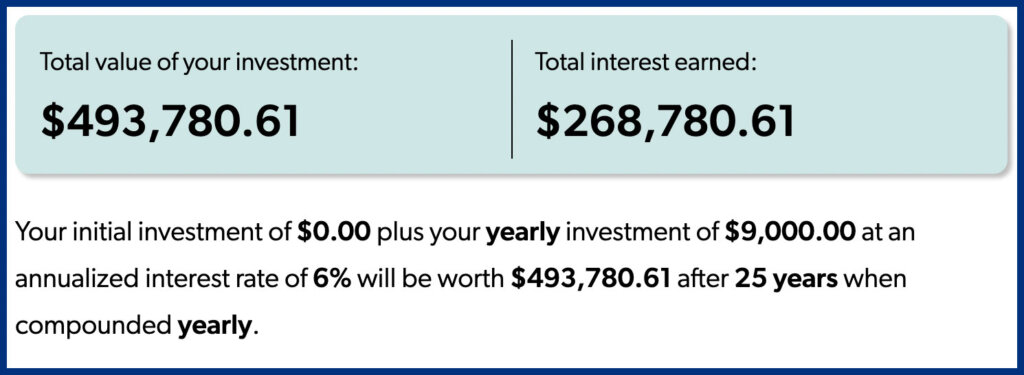

Let’s look at an example of pension-less Johnny, a late starter who prioritized buying a home at age 35 and has not saved a dime for retirement by age 40. Now Johnny is keen to get started and wants to contribute 10% of his $90,000-per-year gross income to invest for retirement.

He does this for 25 years at an annual return of 6% and amasses nearly $500,000 by the time he turns 65.

Keep in mind this doesn’t take any future salary growth into account. For instance, if Johnny’s income increased by 3% annually, and his savings rate continued to be 10% of gross income, the dollar amount of his contributions would climb accordingly each year.

This subtle change boosts Johnny’s RRSP balance to just over $700,000 at age 65.

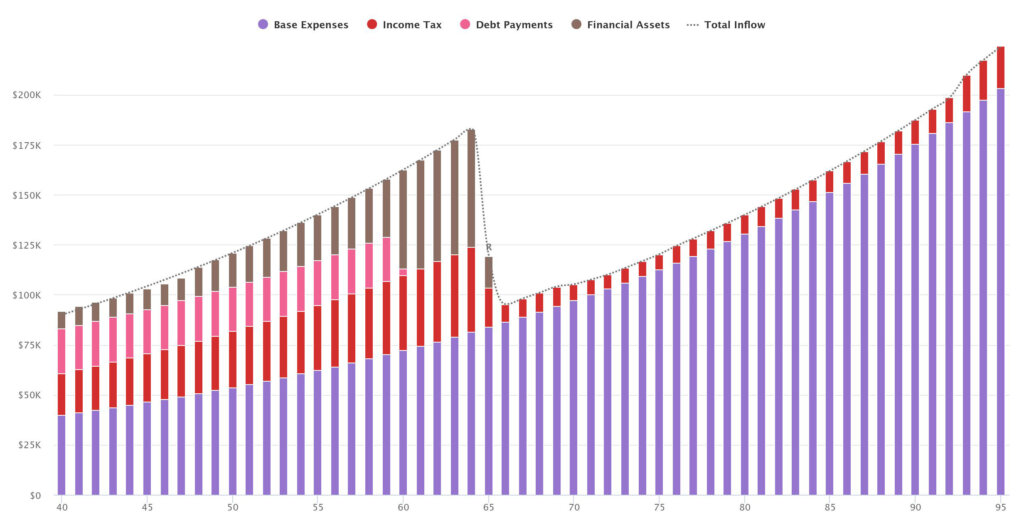

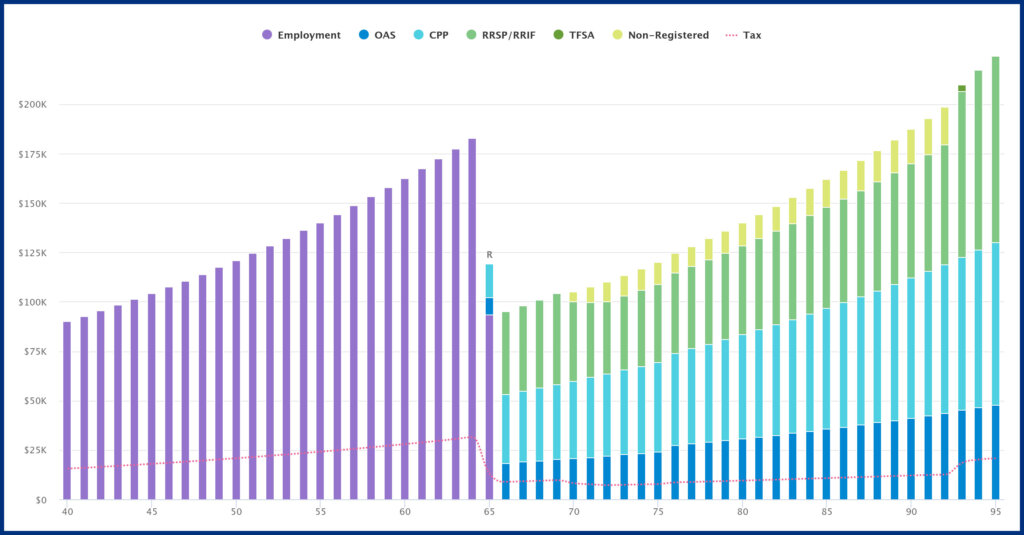

A $700,000 RRSP—combined with expected benefits from the Canada Pension Plan (CPP) and Old Age Security (OAS)—is enough to maintain the same standard of living in retirement that Johnny enjoyed during his working years.

That’s because when his mortgage is paid off, he’s no longer saving for retirement, and he can expect his tax rate to be much lower in retirement.

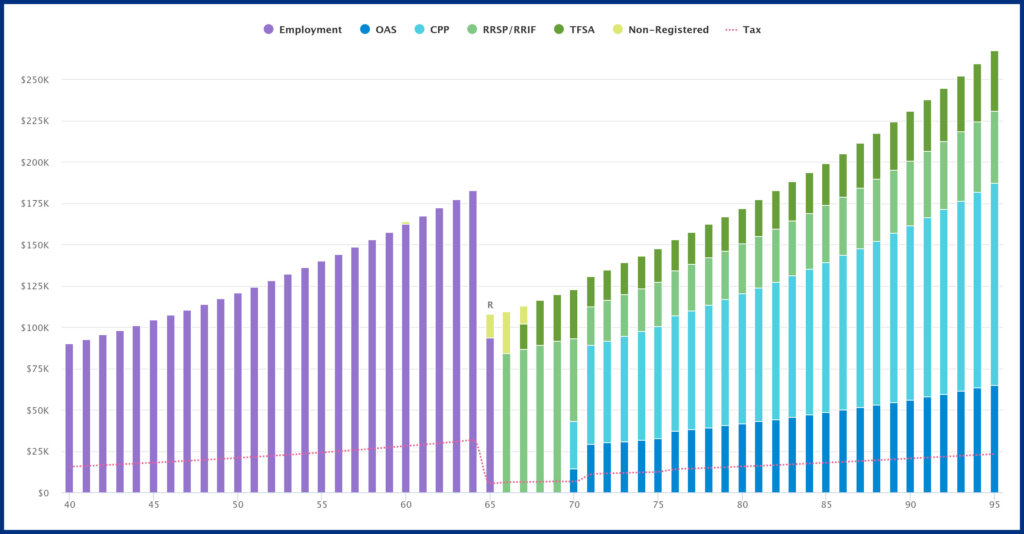

CPP and OAS will add nearly $25,000 per year to Johnny’s annual income (in today’s dollars), if he takes his benefits at age 65. Both are guaranteed benefits that are paid for life and indexed to inflation.

That, combined with the withdrawals from his RRSP and registered retirement income fund (RRIF), allows Johnny to maintain his current lifestyle and enjoy a comfortable retirement.

Even without a pension, Johnny has built a comfortable retirement for himself by simply saving 10% of his income each year and investing prudently inside his RRSP.

Working until 65 ensures he will get a robust retirement pension from the contributory CPP, plus he’s lived in Canada all his life and can expect to receive 100% of his OAS benefits.

Open an RRSP investment account and trade ETFs and stocks with $0 commission on all online stock transactions. No minimum deposit needed.

Earn a guaranteed 4.5% in your RRSP when you lock in for 1 year.

Aside from an RRSP, another powerful tax-advantage account is a TFSA. Check out the best TFSAs in Canada.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

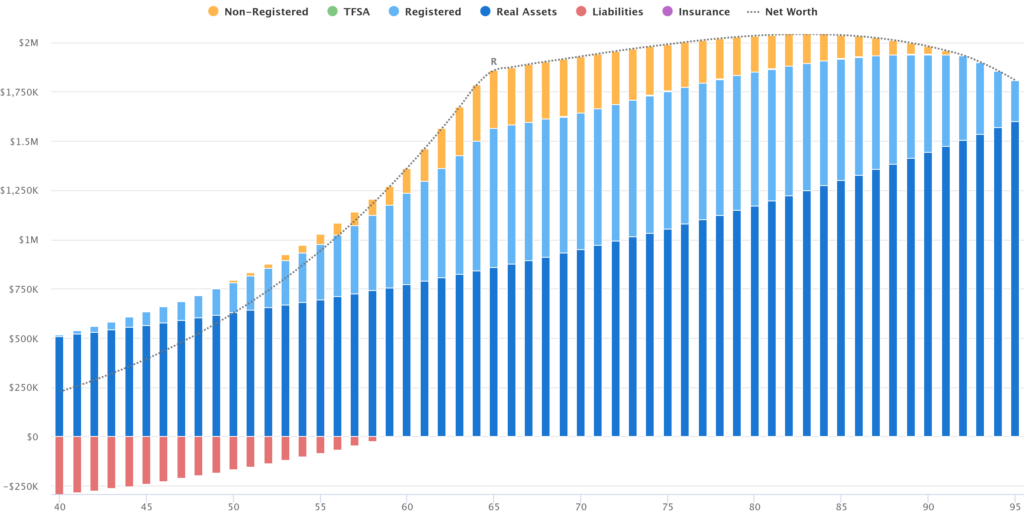

Finally, the ace up the sleeve for Johnny’s retirement is his mortgage-free home. It amounts to equity he could tap by downsizing, selling and renting, taking out a line of credit or using a reverse mortgage if he found himself needing cash flow or a lump sum of money in retirement.

But can Johnny do better? You bet—and you can, too.

By taking advantage of a tax-free savings account (TFSA), Johnny can boost his retirement savings and give his future self the option of retiring slightly earlier or enjoying an increased standard of living in retirement.

Here’s how: At age 45, Johnny starts contributing 3% of his salary to his TFSA to invest for retirement. This is in addition to the 10% he’s already contributing to and investing inside his RRSP.

He contributes at this rate for 15 years; at which time his mortgage is fully paid off at age 60. Johnny takes the extra cash flow freed up from his mortgage and puts it all towards his TFSA, boosting his contributions by another $30,000 per year for his final five working years.

By the time Johnny retires at 65, he’s grown that TFSA to a little over $335,000. That, combined with the $708,000 in his RRSP, puts Johnny’s retirement savings at just over $1 million.

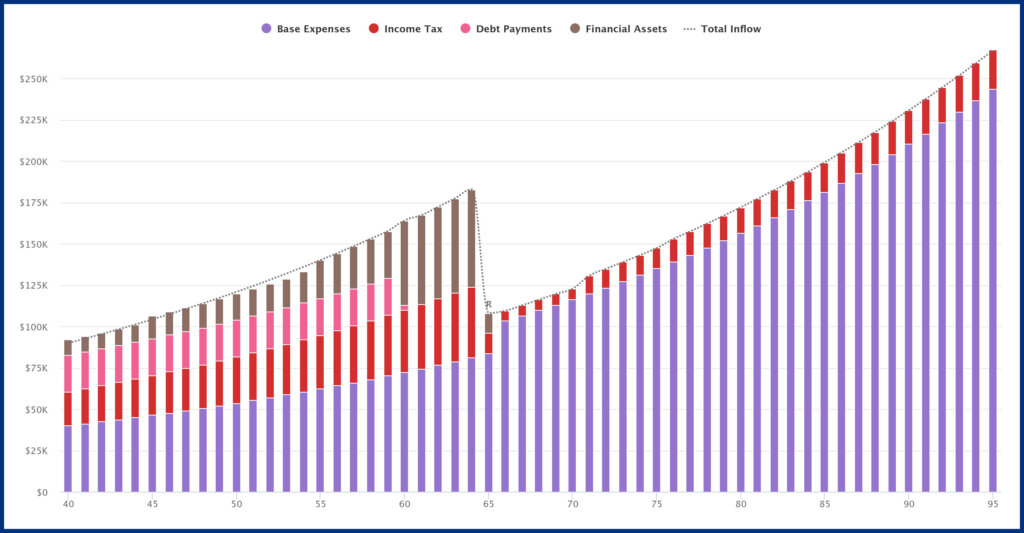

A sustainable spending calculation shows that Johnny can increase his retirement spending from $40,000 per year to $45,000 per year, until age 95, without worrying about running out of money or tapping into his home equity.

But Johnny’s not done yet.

His financial planner smartly points out that by delaying CPP and OAS to age 70, Johnny will receive 42% more CPP and 36% more OAS compared to taking those benefits at age 65. This strategy has shown to improve lifetime spending and even reduce lifetime taxes. The trade-off is for Johnny to withdraw more from his RRSP from age 66 to 70 before the benefits fully kick in.

Earn 3% interest tax fee tax-free interest with flexible withdrawals and zero fees.

Open a TFSA investment account and trade ETFs and stocks with $0 commission on all transactions.

Aside from a TFSA, another powerful tax-advantage account is an RRSP. Check out the best RRSPs in Canada.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

When we put this strategy to the test it boosts Johnny’s annual retirement spending to $48,500 per year—a $3,500-per-year increase in income for the next 30 years.

Indeed, it’s possible to retire comfortably without a pension—even for a late starter with no retirement savings at age 40.

Consider the upside of not having a pension. You’re not forced to contribute 10% or more of your gross income to a pension plan that you cannot access until retirement. This flexibility lets you control the timing and amount of your savings contributions (a double-edged sword, I know).

In retirement, a pension combined with CPP and OAS might be enough to meet all of your monthly cash-flow needs, but what about one-time lump-sum expenses such as a new vehicle, home renovation or repair, bucket-list travel or a financial gift to your children? Harder to do when you’re cash-flow rich and savings poor.

Take stock of your potential sources of retirement income such as OAS, CPP, RRSP/RRIF, TFSA, real estate and other taxable assets.

Understand your current level of spending. That’s the best predictor of our future spending is—what you’re spending now, and that should be the baseline to aim for when you reach retirement.

Strive to contribute 10% of your income towards retirement and do it in a way that mimics the pension plans that you envy—an automatic contribution that aligns with your payday.

Make sure to increase the dollar amount each time you get a pay raise so that you continue contributing a minimum 10% of gross income.

If you have designs on early retirement, or a more luxurious retirement, you’re going to have to save more. The TFSA is your friend. Investments within your TFSA grow tax-free and can be withdrawn tax-free in retirement or whenever you need a top-up to your spending.

CPP and OAS should make up a significant part of your retirement income. Don’t ignore them—use them to your advantage, preferably by delaying the uptake of your benefits to age 70 to maximize the age-deferral credits.

Finally, if you own your home in retirement without a mortgage, consider the paid-off home equity as a fallback option to tap into for annual cash flow or large lump-sum expenses. This can be achieved with a traditional downsizing, but also by selling and renting, taking out a line of credit or using a reverse mortgage.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email