Making sense of the markets this week: August 11, 2024

Japan’s carry trades spook the markets, mixed U.S. earnings are in, Shopify surges, oil and potash remain profitable.

Advertisement

Japan’s carry trades spook the markets, mixed U.S. earnings are in, Shopify surges, oil and potash remain profitable.

Kyle Prevost, creator of 4 Steps to a Worry-Free Retirement, Canada’s DIY retirement planning course, shares financial headlines and offers context for Canadian investors.

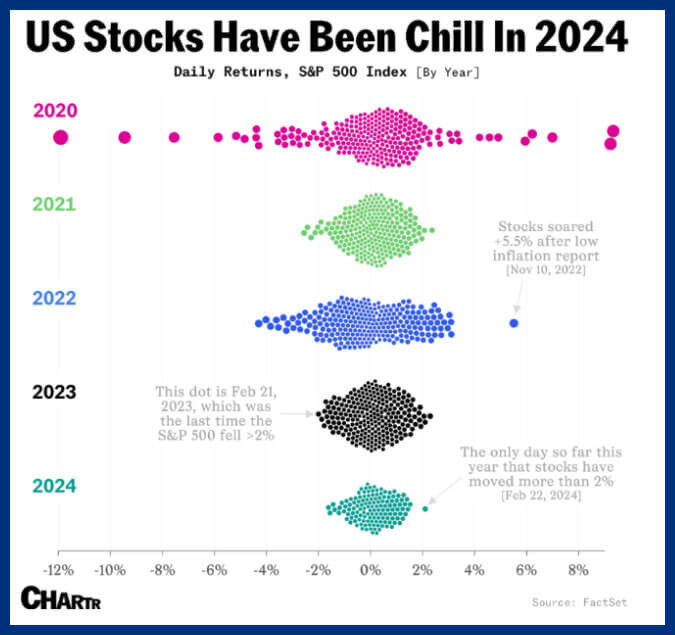

U.S. stocks (and to a lesser degree Canadian stocks) have been on an unprecedentedly-consistent gradual upward trend over the last few years. The chart below illustrates the degree to which the slow-and-steady climb has become the new normal.

Now, compare that to the average historical volatility in the U.S. stock market.

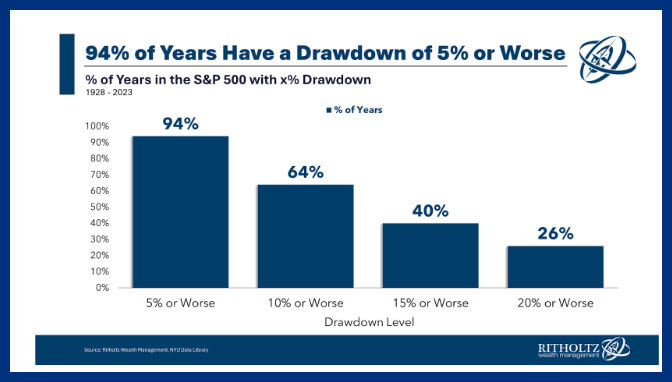

You can see that the outlier isn’t the years we have a large market corrections, but rather the years when we don’t.

That big picture perspective is important in weeks like the one we just experienced. Here’s a timeline of some of the major developments that took place from August 2 to 8.

| Day | What the heck happened? |

|---|---|

| Friday, August 2 | • The S&P 500 lost 1.8%, and the Nasdaq lost 2.4%, taking the Nasdaq down 10% off its high on July 10, into a correction. |

| Monday, August 5 | • Japan’s stock market (as measured by the Nikkei 225) kicked off the day posting a 12% loss—its biggest one-day loss in history. • The S&P 500 and Nasdaq lost 3% and 3.4% respectively. This was the S&P 500’s largest percentage loss since 2022.Canada’s TSX Composite Index fared much better, partially due to markets being closed on Monday, going down 2.18% on Friday, and then 1.12% on Tuesday. • Bitcoin got slammed substantially worse than the stock markets did, as it briefly dropped below USD$50,000 on Monday, losing about 30% of its value in a week and erasing all gains made since February. |

| Tuesday/Wednesday, August 6/7 | • The Nikkei proceeded to claw back almost all of Monday’s losses. The S&P 500 basically treaded water, as it was up 1.04% on Tuesday, down 0.77% on Wednesday. |

| Thursday, August 8 | • Thursday saw a further market rebound as the S&P 500 had its best day since 2022, rising 2.3%, the TSX Composite went up 1.6%. |

All that frenetic trading activity panicked a lot of traders who hadn’t seen that type of stock-market volatility around the globe since 2020. The CBOE Volatility Index (better known as the VIX) is an oft-cited measure of the level of fear or uncertainty in the market. As you can see in the graph below, there was clearly a sudden ramp-up of market stress that didn’t fully dissipate this week.

So… why did all this happen?

The truth is it’s difficult to tell how much each single variable is responsible for the market collapse, when so many different variables are all interacting. Here are some of the prominent theories.

So, the real question is: “What should you do about it?” The answer: “Probably not much.”

The American economy is growing at an annualized rate of 2.8%. I’ve been saying this for a while now: Canadian stocks appear to be more fairly valued than the tech-heavy counterparts in the States. So, I think there’s no need to panic.

Read: Why did the stock markets fall?

Read: What is a carry trade?

If you lost sleep this week, it may be time to reevaluate whether your investment portfolio is appropriate for your risk tolerance level, and adjust accordingly. For what it’s worth, these market pullbacks (aside from the Japanese market gyrations) were well within historical norms. For more information, check out our article on Canadian recession investments at MillionDollarJourney.com.

Provide a 30-day notice before withdrawing your cash and earn 5% (or 4.5% when you provide 10-day notice).

Lock in your deposit for one year and earn a guaranteed interest rate of 4.85%.

$0 commission on all online stock transactions. No minimum deposit needed.

MoneySense is an award-winning magazine, helping Canadians navigate money matters since 1999. Our editorial team of trained journalists works closely with leading personal finance experts in Canada. To help you find the best financial products, we compare the offerings from over 12 major institutions, including banks, credit unions and card issuers. Learn more about our advertising and trusted partners.

Shopify’s market value increased by 17.8% on Wednesday, leapfrogging it from Canada’s ninth largest company to fourth largest (and it was knocking on Enbridge’s door for third place). That massive market response is especially noteworthy given all the market turmoil this week, and last week’s U.S. tech weakness.

Here’s what came from the quarterly call this week.

“I think that our merchants do seem to be, you know, outperforming and doing better than others. And, I think a big part of the reason that we are not seeing the same thing that others might is because we simply have merchants across a ton of verticals and across a ton of [geographies].”

–Harley Finkelstein, president, Shopify

Shopify’s gross merchandise volume was up 22% for the quarter, and operating margin was up significantly, due to subscription revenues from client firms. Shopify’s strategy to increase prices for premium services used by larger companies appears to be working for its bottom line.

June saw Shopify roll out its new AI-tools, designed to help small- and medium-sized businesses improve their marketing and conversion efficiency. Finkelstein commented that, “More and more merchants across the world are putting their trust in Shopify’s unified commerce operating system to fuel growth and simplify complex operations.”

There could still be room to grow, as the share price is still down about 10% so far in 2024.

Last week’s Big Tech earnings reports failed to paint a clear picture for investors, and those mixed results continued this week.

All numbers below are presented in U.S. dollars.

Airbnb’s earnings call was perhaps the most noteworthy. After the company shared that it missed earnings expectations, the shares dropped 14% in after-hours trading on Tuesday night. Citing slowing demand from U.S. customers as the main reason for lowered earnings, management was quick to point out that revenue was still up 11% year over year, and that Asia Pacific and Latin America were leading verticals for growth.

Despite the healthy earnings beat on Wednesday, Disney shares were down 4% as investors appear reluctant to jump back into the stock. The big highlight of the quarter was that Disney’s combined streaming platforms turned a profit for the first time, with the combination of Disney+, Hulu and ESPN+ posting an operating profit of $47 million.

That obviously compares favourably with a loss of more than half a billion for the quarter last year. Disney announced streaming price hikes were on the way

“We’re seeing growth in consumption and the popularity of our offerings, which gives us the pricing leverage we believe we have.” He went on to add, “I feel very bullish about the future of this business. We’re not saying much more about it, except you can expect it to grow nicely in fiscal 2025.”

—Bob Iger, CEO, Disney

Disney Parks and Experiences Division saw its operating income dip 6% in U.S. parks and had an uptick of 2% in its international locations.

“We saw a slight moderation in demand, I certainly wouldn’t call it a significant change. I would just call this a bit of a slowdown that’s being more than offset by the entertainment business.”

—Hugh Johnston, CFO Disney

It appears the market perceived declining profits as more of a “significant change” than the Disney executives did.

Reddit continues to show signs of eventual profitability, as the company’s net loss was down to $10.1 million from $41.1 million in the second quarter last year. Revenues were up 54% year on year, and online advertising sales continue to improve after dipping in 2022. Despite this good news, Reddit shares are down more than 20% over the last five trading days. They are still down slightly year-to-date.

While the world’s economy might be slowing down, demand for oil and potash was still relatively solid last quarter.

Here’s a snapshot of the earnings this week. (Nutrien is listed on both the New York and Toronto stock exchanges reports earnings in U.S. dollars.)

Canada’s second largest oil producer, Suncor, had another excellent earnings report on Wednesday. That marked the fourth straight quarter that the company has outperformed earnings expectations by 10% to 18%. Total production was up from 741,900 barrels per day in the second quarter of 2023, to 770,600 barrels per day this year.

CEO Rich Kruger reports that Suncor continued to be focused on improving operational efficiency and cutting costs, specifically citing down time for maintenance as a key objective. Kruger was upbeat on the earnings call, saying “The sun is shining on this company, and we plan to make hay in the second half of the year.” As long as crude prices can stay above $70 per barrel, Suncor should continue to see sunny days. Suncor’s share price was up 4.54% after announcing earnings on Wednesday.

Nutrien managed an earnings beat, but came up short on revenue. Lower operating costs and increased crop input margins were responsible for squeezing out the better-than-expected profit. Weather issues in Brazil and reduced potash prices meant that year-over-year sales numbers for the potash division were 25% lower. Nutrien shares were down 2.32% on Thursday after announcing earnings.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email